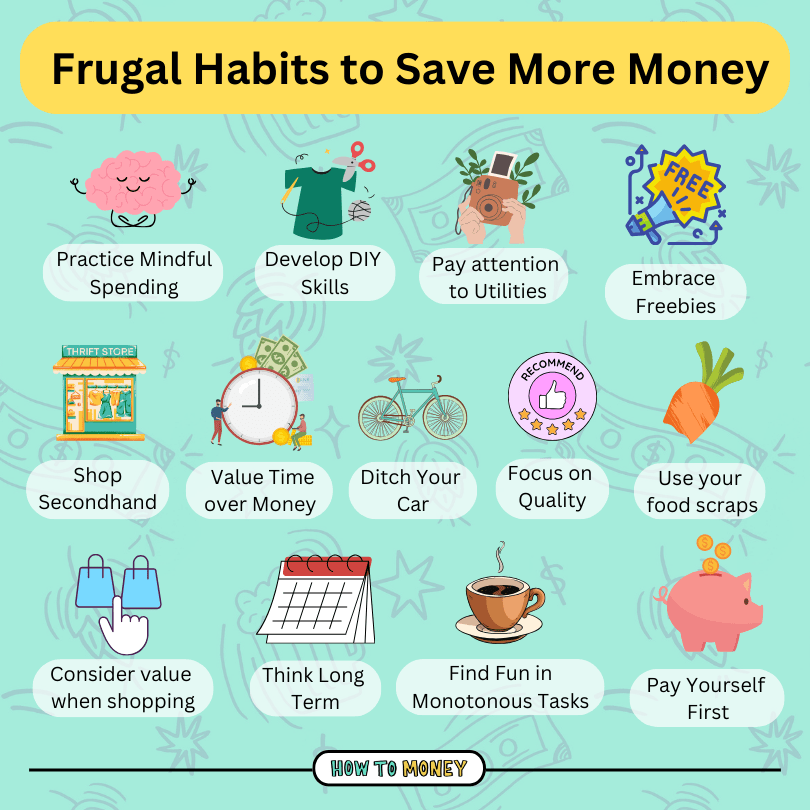

Saving money is a goal that many people strive for, and there are various ways to cut back on expenses and live a more frugal lifestyle. In this blog post, I will share some personal experiences and informative tips on how to save money on everyday expenses.

1. Track your expenses

I used to be oblivious to where my money was going each month until I started tracking my expenses. By keeping a detailed record of every purchase, I was able to identify areas where I was overspending. There are many apps available that can help you with this task, or you can simply use a spreadsheet or notebook. This simple step made a huge difference in my financial awareness and helped me prioritize my spending.

2. Cook at home

Eating out can be convenient, but it can also be costly. I used to spend a significant portion of my income on dining out until I realized how much money I was wasting. Cooking at home not only saves money but also gives you control over the ingredients and portion sizes. Meal planning can help you make a grocery list and avoid unnecessary purchases. Plus, cooking can be a fun and creative activity that brings you closer to loved ones.

3. Shop smarter

Grocery shopping is a necessary expense, but there are ways to save money without compromising the quality of your meals. One of my favorite tricks is to create a weekly meal plan and then make a list of the needed ingredients. Stick to your list and avoid impulse purchases. Another helpful tip is to compare prices and look for sales or discounts. Buying non-perishable items in bulk can also help save money in the long run.

4. Embrace couponing and cashback apps

Couponing used to be associated with extreme couponers who spent hours clipping coupons. However, with digital coupons and mobile apps, saving money has become much easier. There are many websites and apps that offer discounts and cashback on various products. Take advantage of these opportunities and make it a habit to check for coupons before making any purchase.

5. Cut cable and opt for streaming services

Cable bills can add up quickly, and often we end up paying for channels and shows that we don’t even watch. Consider cutting your cable subscription and switching to more affordable streaming services. With the wide range of options available today, you can find platforms that offer your favorite shows and movies at a fraction of the cost. You can also explore free alternatives like YouTube or library rentals.

6. Save on energy bills

Energy costs are another area where you can make a significant impact on your monthly budget. Simple changes like turning off lights when you leave a room, switching to energy-efficient light bulbs, and unplug electronics when not in use can help reduce your energy consumption. Additionally, adjusting your thermostat by a few degrees or using a programmable thermostat can save you money on heating and cooling expenses.

7. Rethink transportation

Transportation costs can eat up a significant portion of your budget, especially if you rely heavily on your car. Consider alternative modes of transportation like biking, walking, or using public transportation if available. Carpooling or ridesharing with friends or colleagues can also help cut down on fuel costs. If owning a car is not a necessity for you, selling your vehicle altogether could free up a substantial amount of money in the form of insurance payments, fuel, and maintenance expenses.

8. Utilize libraries and second-hand stores

Books, movies, and even clothes can be expensive, but there are affordable alternatives available. Public libraries offer a vast selection of books and movies for free. Borrowing instead of buying not only saves you money but also helps reduce clutter in your home. Additionally, consider shopping at thrift stores or consignment shops for clothes and household items. You can often find high-quality items at a fraction of the price.

9. DIY and learn new skills

Instead of paying for professional services, find ways to do things yourself. There are many tutorials and online resources available that can help you learn new skills. Simple tasks like basic home repairs, gardening, or even grooming your pet can save you money in the long run. Additionally, learning to sew or mend clothes can extend the life of your wardrobe and save you from buying new items.

10. Prioritize experiences over material possessions

Lastly, shifting your mindset and prioritizing experiences over material possessions can help you save money in more than one way. Instead of spending money on things that will quickly lose their value, invest in creating memories. Spend time with loved ones, explore nature, or engage in hobbies that bring you joy. These experiences can be fulfilling and often cost very little or nothing at all.

In conclusion, living frugally doesn’t mean living miserably. By implementing some, if not all, of these tips, you can save money on everyday expenses without sacrificing quality or enjoyment. Remember, it’s not about depriving yourself, but rather making conscious choices that align with your financial goals and values. Happy saving!