Are you tired of living paycheck to paycheck? Do you find yourself constantly dreaming about that dream vacation or that brand-new gadget, only to be disappointed by the lack of funds? Trust me, I’ve been there. But fear not! There are some fun and innovative ways to boost your savings and finally turn those dreams into a reality.

Let’s face it – saving money can be quite the challenge. It requires discipline, determination, and a lot of willpower. However, it doesn’t have to be a boring and daunting task. With a little creativity, saving money can actually be an enjoyable and rewarding experience. So how exactly can we make saving money a fun endeavor? Let’s dive in!

The first thing you need to do is set a clear goal. And not just any goal – a specific and realistic one. Whether it’s saving for a down payment on a house, a dream vacation, or simply building an emergency fund, having a goal to work towards will keep you motivated and focused. Visualize your goal, create a vision board or a savings jar, do whatever it takes to keep that goal at the forefront of your mind.

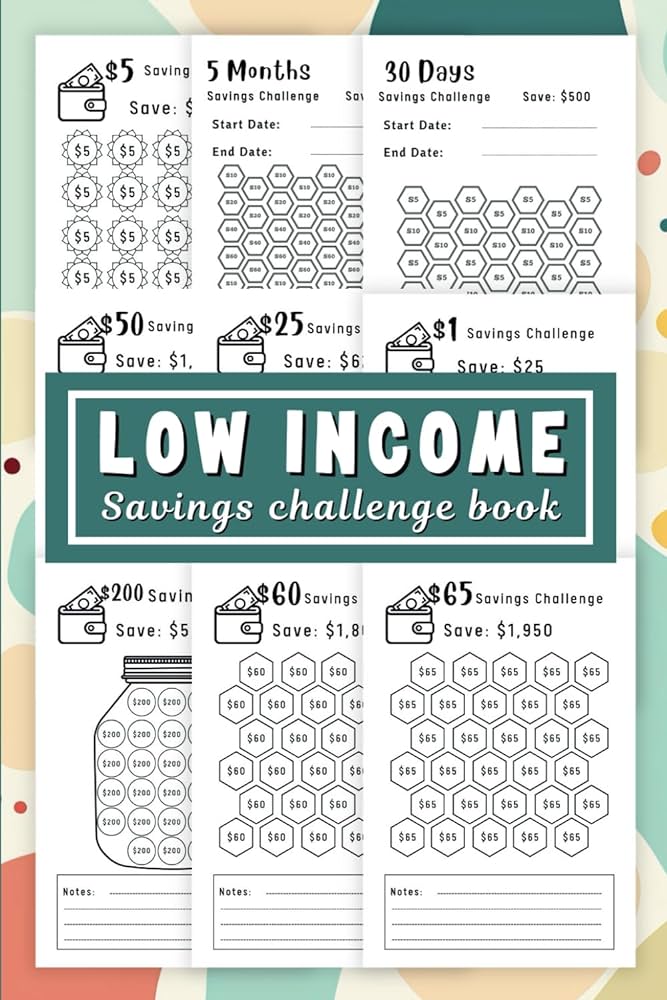

Now that you have a clear goal, it’s time to make saving money a fun game. One popular method is the 52-week challenge. Start by saving $1 in the first week, $2 in the second week, $3 in the third week, and so on. By the end of the year, you’ll have saved over $1,300! Not only does this method encourage you to save gradually, but it also allows you to witness your savings grow week by week, which can be incredibly motivating.

Another fun way to boost your savings is by participating in savings challenges with friends or family members. Create a friendly competition to see who can save the most money each month or quarter. You can even set rewards for the winner, such as a dinner treat or a day out. Not only does this make saving more enjoyable, but it also provides a support system and accountability partners who can cheer you on and keep you on track.

If you’re a tech-savvy individual, there are several apps and online tools that can turn saving money into a game-like experience. These apps often come with features like goal tracking, financial challenges, and even virtual rewards for reaching certain milestones. You can earn points, badges, or even cashback rewards for saving money consistently. It’s like turning your savings journey into a personalized video game where you’re the ultimate winner.

Speaking of rewards, it’s important to treat yourself along the way. Saving money doesn’t mean depriving yourself of all the things you love. It’s about finding a balance between saving and enjoying your life. Set small rewards for yourself when you reach certain milestones. It could be a spa day, a fancy dinner, or that item you’ve been eyeing for months. By rewarding yourself, you’ll stay motivated and avoid feeling deprived, ultimately making the saving process more enjoyable.

In addition to these challenges and techniques, there are also some simple yet effective strategies that can help you boost your savings even further. One such strategy is to automate your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you won’t even have to think about it, and your savings will grow effortlessly.

Another helpful tip is to take advantage of cashback and couponing opportunities. Before making any purchase, make it a habit to search for available discounts, promotional codes, or cashback offers. You’d be surprised at how much money you can save by just being a smart shopper.

Lastly, it’s crucial to track your expenses and identify areas where you can cut back. By analyzing your spending habits, you can pinpoint any unnecessary expenses and redirect that money towards your savings. It may require some sacrifices and lifestyle adjustments, but in the long run, it will all be worth it.

Saving money doesn’t have to be a tedious and mundane task. With a little creativity and a positive mindset, you can turn it into a fun and exciting adventure. So why not start today? Set your goals, challenge yourself, and watch your savings grow. Remember, every little bit counts, and you’re one step closer to achieving those dreams you’ve always desired.