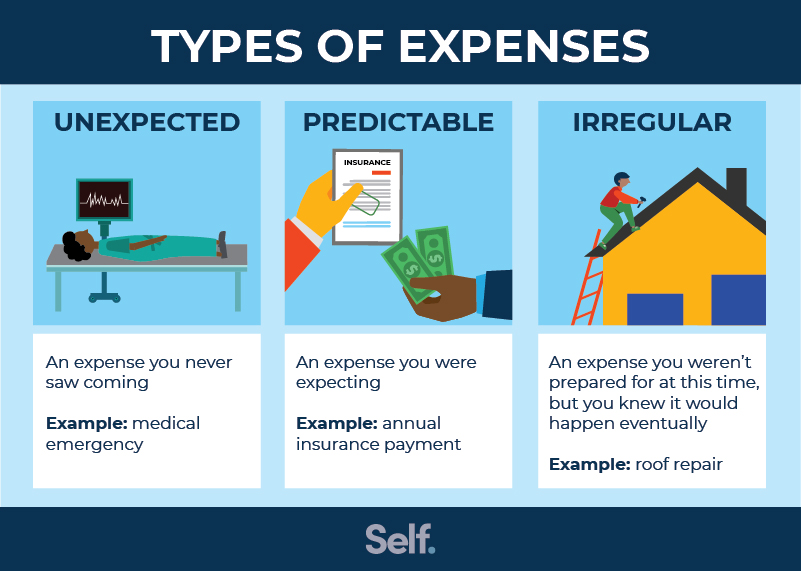

Life is full of surprises, both big and small. Sometimes they bring joy and excitement, but other times they bring unexpected expenses that can throw off even the most carefully planned budgets. It’s during these challenging times that having a solid financial plan in place becomes essential.

I know this from personal experience. A few months ago, I found myself facing one of those dreaded unexpected expenses. My car, which had faithfully served me for years, suddenly broke down, leaving me stranded on the side of the road. As I waited for a tow truck, my mind started racing, thinking about how much this unexpected repair would cost and how it would affect my budget.

It’s in moments like these that we need to take a deep breath and remind ourselves that unexpected expenses are a part of life. Instead of panicking, I began to reflect on the importance of having a financial plan that can weather such storms. Through trial and error, I’ve developed a few strategies that have helped me better navigate these unexpected expenses, and I hope they can help you too.

The first step is to establish an emergency fund. Having a cushion of savings specifically set aside for unexpected expenses can alleviate the stress and financial strain in times like these. Aim to set aside three to six months’ worth of living expenses in an easily accessible account. By starting small and consistently contributing, you’ll build up your emergency fund over time, creating a safety net for unexpected expenses.

Another crucial aspect of budgeting for unexpected costs is to prioritize your spending and identify areas where you can cut back. Take a close look at your budget and identify any non-essential expenses that can be temporarily eliminated or reduced. By making small sacrifices in areas like entertainment or dining out, you can redirect those funds towards your emergency fund, giving it a boost that will come in handy when the unexpected happens.

Insurance coverage is another essential component of financial planning. Make sure you have adequate insurance for your car, home, health, and any other areas that may be vulnerable to unexpected expenses. While insurance premiums may seem like an extra burden on your budget, they can provide peace of mind and protection when you need it most. Be sure to review your policy regularly to ensure it aligns with your current needs and circumstances.

Investing in your education and knowledge is also a valuable way to prepare for unexpected expenses. Take the time to educate yourself about personal finance, budgeting, and financial planning. There are numerous resources available, such as books, podcasts, and online courses, that can provide you with the necessary tools and knowledge to make informed decisions about your money. The more you understand about personal finance, the better equipped you’ll be to handle unexpected costs when they arise.

In addition to education, it’s essential to surround yourself with a supportive network of friends and family who can provide guidance and advice in times of financial uncertainty. Seek out the advice of those who have weathered similar storms and come out on top. Their experiences and insights can be invaluable in helping you navigate unexpected expenses and come up with creative solutions.

Lastly, remember to practice self-care during trying times. Dealing with unexpected expenses can be incredibly stressful and overwhelming, and it’s essential to prioritize your mental and emotional well-being. Take moments for yourself, engage in activities that bring you joy, and lean on your support system. By taking care of yourself, you’ll be better equipped to tackle the challenges that lie ahead.

Life’s surprises may be inevitable, but with a solid financial plan in place, you can approach them with confidence and resilience. Establishing an emergency fund, prioritizing your spending, maintaining adequate insurance coverage, investing in your financial education, and surrounding yourself with a supportive network are all crucial steps in preparing for unexpected expenses. By taking proactive measures, you can tackle life’s surprises head-on and come out stronger on the other side.