-

Estate Planning: Securing Your Legacy and Assets

When it comes to estate planning, many people tend to think that it only applies to the wealthy or the elderly. However, in reality, estate planning is something that everyone, regardless of age or wealth, should consider. It is about securing your legacy and ensuring that your hard-earned assets are protected and distributed according to…

-

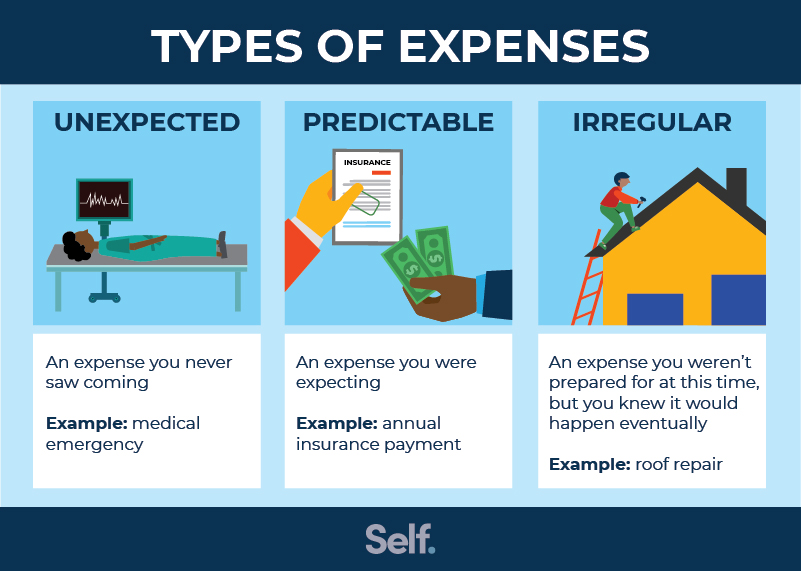

Handling Unexpected Expenses: Budgeting for Life’s Surprises

Life is full of surprises, both big and small. Sometimes they bring joy and excitement, but other times they bring unexpected expenses that can throw off even the most carefully planned budgets. It’s during these challenging times that having a solid financial plan in place becomes essential. I know this from personal experience. A few…

-

Retirement Savings Strategies for Self-Employed Individuals

As a self-employed individual, retirement savings can feel like a daunting task. With no employer-sponsored retirement plan, it’s up to us to take control of our financial future. However, with the right strategies and a little discipline, we can build a solid retirement nest egg. In this blog post, I’ll share my personal experiences and…

-

Planning for Major Expenses: Creating a Financial Roadmap

As we go through life, we are often faced with major expenses that can either bring excitement or dread. Whether it’s buying a house, paying for education, or starting a family, these milestones require careful planning and financial commitment. It can feel overwhelming to think about how to budget for these significant expenses, but with…

-

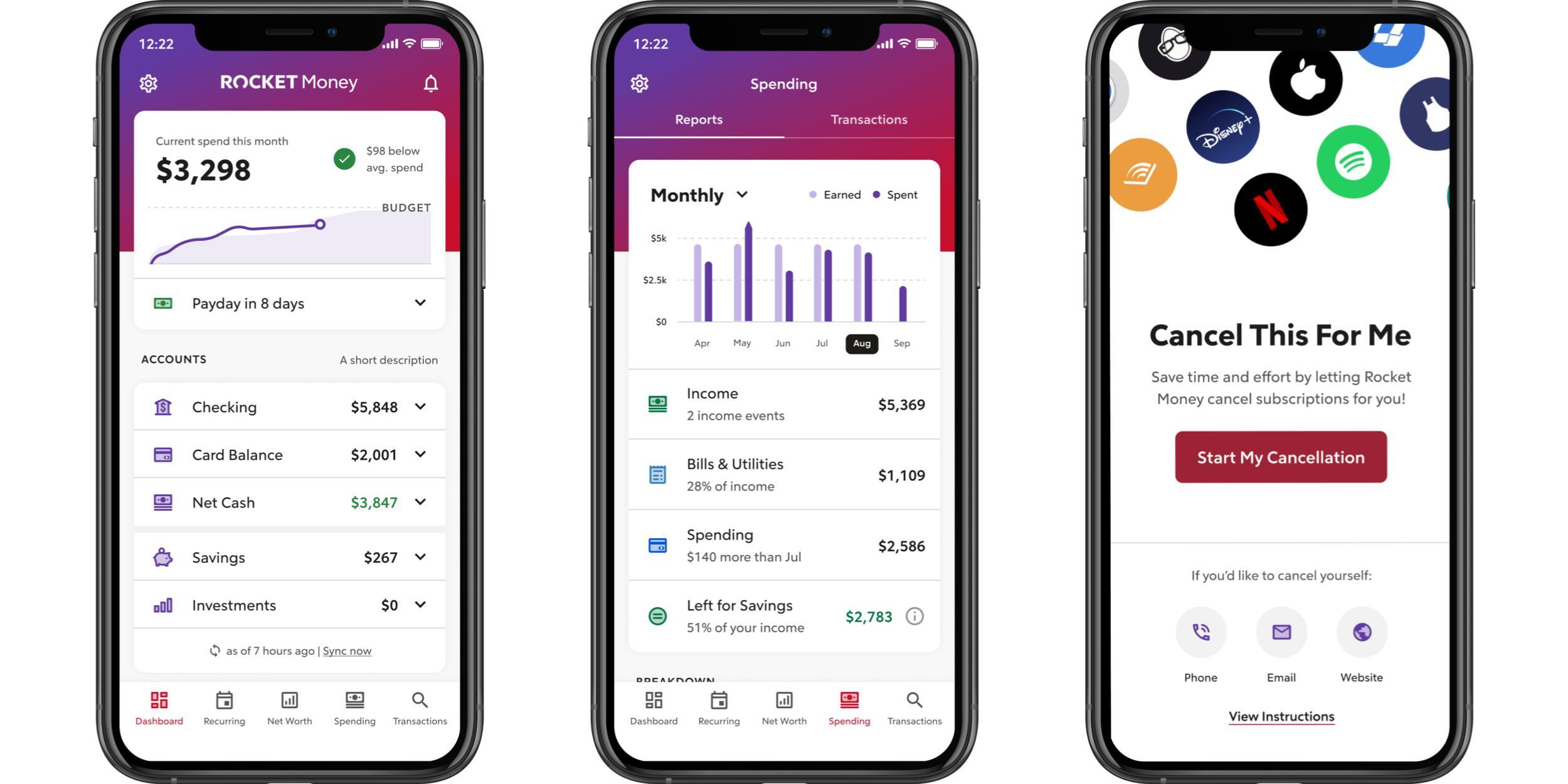

Financial Apps and Tools for Better Money Management

When it comes to managing our finances, we often find ourselves overwhelmed with the plethora of options available. From budgeting apps to investment tools, there seems to be a never-ending stream of financial apps and tools promising to help us achieve better money management. As someone who has tried and tested numerous apps over the…

-

Teaching Kids about Money: Financial Education for Children

Growing up, I never really had a strong understanding of money. Sure, I knew that I needed it to buy things and that my parents worked hard to earn it, but the concept of managing money was lost on me. It wasn’t until I became an adult that I realized the importance of financial education,…

-

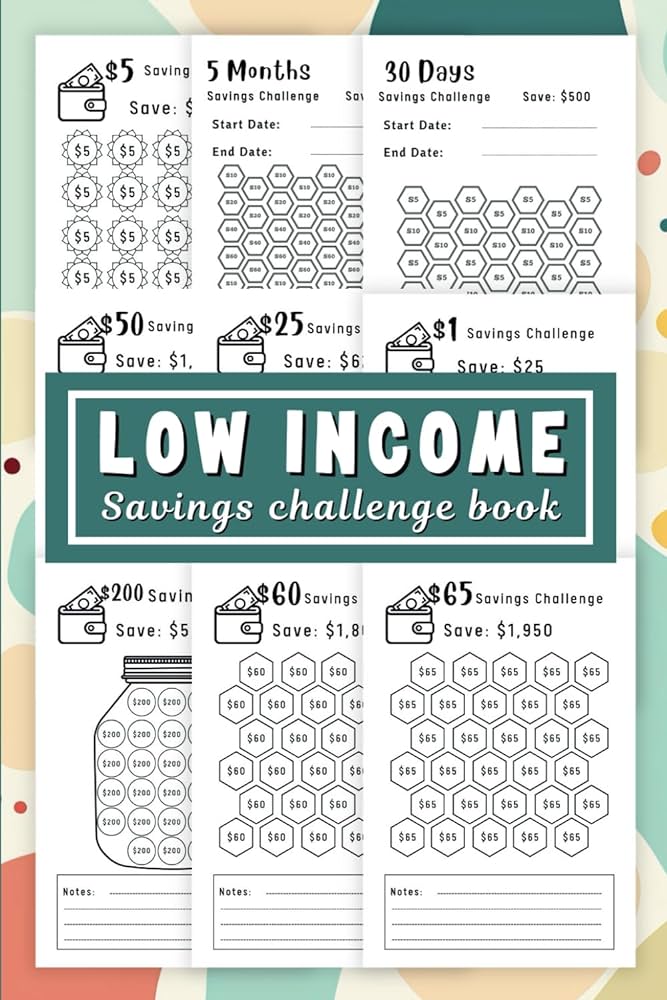

Savings Challenges: Fun Ways to Boost Your Savings

Are you tired of living paycheck to paycheck? Do you find yourself constantly dreaming about that dream vacation or that brand-new gadget, only to be disappointed by the lack of funds? Trust me, I’ve been there. But fear not! There are some fun and innovative ways to boost your savings and finally turn those dreams…

-

Real Estate Investment: Building Wealth through Property

I remember the very first time I dipped my toes into the world of real estate investment. It was a mix of excitement and nerves as I contemplated whether or not I was making the right decision. Would investing in property truly provide the financial security and wealth-building opportunities that I yearned for? Little did…

-

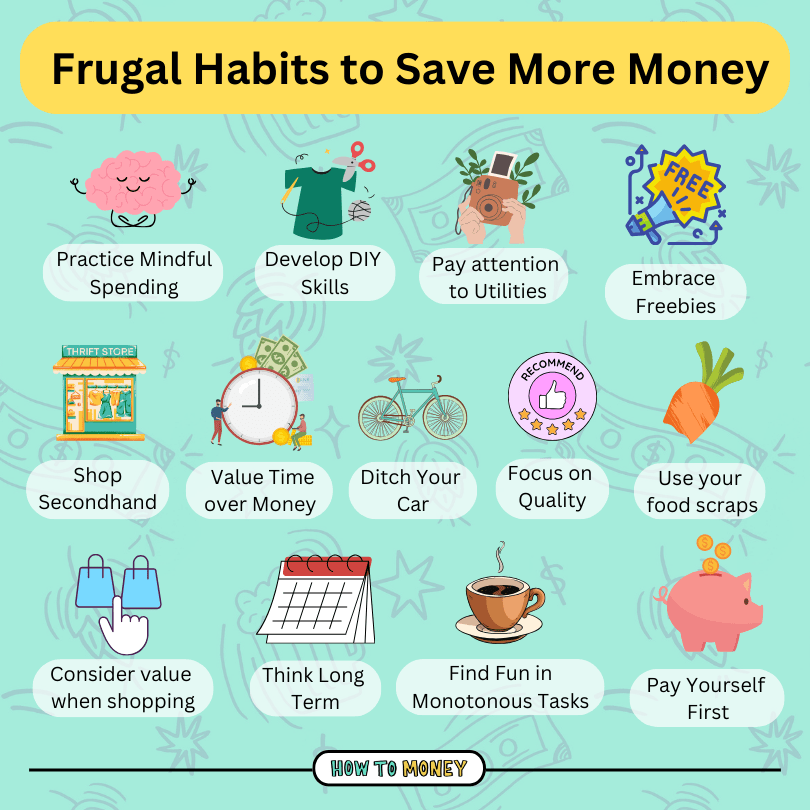

Frugal Living Tips: Saving Money on Everyday Expenses

Saving money is a goal that many people strive for, and there are various ways to cut back on expenses and live a more frugal lifestyle. In this blog post, I will share some personal experiences and informative tips on how to save money on everyday expenses. 1. Track your expenses I used to be…

-

Investing in Stocks: A Beginner’s Guide

I still remember the first time I considered investing in stocks. The thought of potentially growing my wealth was both exciting and intimidating. Like many beginners, I had a lot of questions and concerns. How do I even start? Can I really make money in the stock market? Thankfully, I took the plunge, educated myself,…