When it comes to personal finance, one of the most important tools you can have in your arsenal is a practical monthly budget. It might not sound like the most exciting topic, but trust me when I say that a well-designed budget can have a profound impact on your financial success. Now, I know what you’re thinking – budgets sound restrictive and limiting. However, with a little bit of planning and some discipline, a budget can actually give you the financial freedom you crave.

Let’s dive into the world of budgeting and explore how you can create a practical monthly budget that will set you up for financial success.

Step 1: Set Clear Financial Goals

Before you start crunching numbers, it’s important to have a clear understanding of your financial goals. What are you trying to achieve? Maybe you’re aiming to pay off your student loans, save for a down payment on a house, or build an emergency fund. By having a specific target in mind, you can tailor your budget to align with those goals.

Step 2: Calculate Your Income

The next step is to determine your total monthly income. This includes not only your salary but also any additional sources of income such as freelance work, rental property, or investments. It’s crucial to have an accurate representation of your income, as it will serve as the foundation for your budget.

Step 3: Track Your Expenses

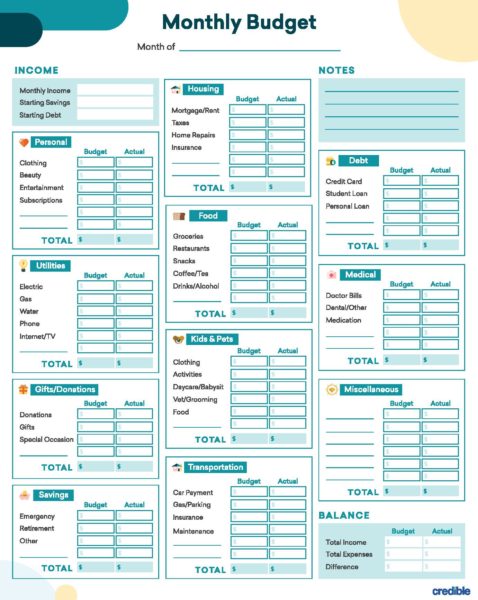

Now it’s time to get honest with yourself and track your expenses. This involves going through your bank statements and credit card bills to identify where your money is going each month. Categorize your expenses into fixed costs (rent/mortgage, utilities, etc.) and variable costs (groceries, dining out, entertainment). This exercise will give you a clear picture of your spending habits and help identify areas where you can cut back.

Step 4: Set Spending Limits

Based on your income and expenses, it’s time to set spending limits for each category. This is where the budgeting magic happens. Assign a specific dollar amount to each expense category and make sure it aligns with your financial goals. Be realistic about your spending limits, so you don’t feel deprived. The key is finding a balance between enjoying your money and saving for the future.

Step 5: Prioritize Savings

No budget is complete without a section for savings. Make it a priority to save a certain percentage of your income each month. Whether it’s 10% or 30%, the choice is yours. Automate your savings by setting up automatic transfers from your checking account to a separate savings account. By making savings a non-negotiable part of your budget, you’ll be building a safety net for future financial emergencies or working towards specific goals.

Step 6: Review and Adjust

Creating a budget isn’t a one-and-done task. It’s an ongoing process that requires periodic review and adjustment. Track your spending each month and compare it to your budgeted amounts. Identify areas where you overspent or where you had extra money left over. This will help you refine your budget and make necessary adjustments for the following months.

Step 7: Stay Disciplined and Flexible

Sticking to your budget requires discipline and flexibility. There will be months where unexpected expenses arise, or you might feel tempted to overspend. It’s important to stay committed to your financial goals and make conscious decisions about how you allocate your money. Remember, a budget is a tool to help you achieve financial success, not a set of rigid shackles.

In conclusion, creating a practical monthly budget is a crucial step towards financial success. It allows you to take control of your money, prioritize your goals, and make informed decisions about your spending. By setting clear financial goals, tracking your income and expenses, prioritizing savings, and staying disciplined, you can create a budget that will set you up for a bright financial future. So why wait? Start budgeting today and take charge of your financial destiny!