-

Financial Education for Beginners: Money Management Basics

When I first started working and earning my own money, I felt a sense of freedom and independence. But along with that came a newfound responsibility that I wasn’t fully prepared for – managing my own finances. The truth is, financial education is something that is often overlooked, and many of us are left to…

-

Financial Goals Setting: Achieving Your Money Dreams

We all have dreams, aspirations, and goals we want to achieve in our lives. Some of these goals may be personal in nature, while others may be related to our career, relationships, or personal growth. However, there is one aspect of our lives that often gets overlooked when it comes to setting goals – our…

-

Tax Planning Strategies: Minimizing Your Tax Liability

When it comes to tax planning, the goal is simple: minimizing your tax liability. As April 15th looms closer, many of us start to feel the weight of filing our taxes. But with the right strategies and a bit of planning, tax season doesn’t have to be a stressful time. In this blog post, I…

-

Smart Spending Habits: Making the Most of Your Money

We all want to make the most of our hard-earned money, especially in today’s uncertain economic times. It’s easy to get caught up in the cycle of living paycheck to paycheck, wondering where all our money goes. But fear not, my friends, because I’m here to share some smart spending habits that will not only…

-

Credit Score 101: Understanding and Improving Your Credit

Have you ever felt like your credit score is some mysterious number floating out there in the universe, controlling your financial fate? Trust me, I’ve been there. It wasn’t until recently that I decided to really dive into the world of credit scores and learn how they work. And let me tell you, the information…

-

Saving for Retirement: Planning Your Financial Future

Saving for retirement is something that often gets pushed to the back burner, especially when we’re young and focused on building our careers or starting a family. It’s easy to think that retirement is so far away and that there’s plenty of time to start saving later. But the truth is, time flies, and before…

-

The Importance of Emergency Funds: Financial Security

When it comes to managing our finances, there is one aspect that is often overlooked or underestimated – the importance of having an emergency fund. Many of us may find it challenging to set aside money for unexpected expenses or emergencies, but I can personally attest to the peace of mind and financial security that…

-

Debt Management Tips: How to Get Out of Debt Faster

Debt. It’s a word that can strike fear into the hearts of many. It’s something that most of us have experienced at some point in our lives, and it can feel overwhelming and suffocating. But I’m here to tell you that there is hope. There are steps you can take to get out of debt…

-

Investment Strategies: Building Wealth for the Future

As the saying goes, “Don’t put all your eggs in one basket.” This popular saying holds true, especially when it comes to building wealth for the future. We all dream of financial independence, a comfortable retirement, and a life free from the constraints of money worries. But how do we achieve this? How do we…

-

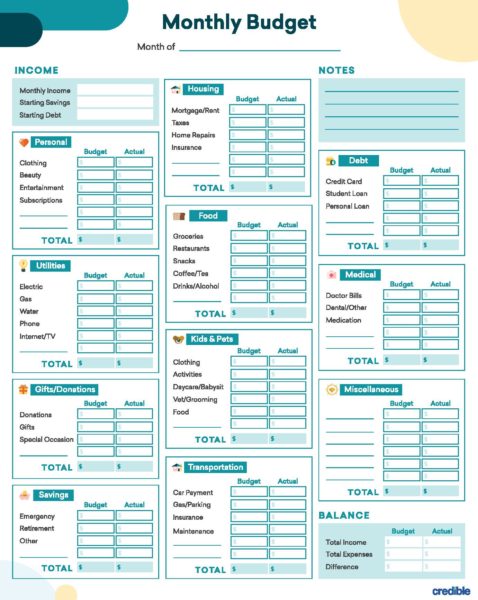

Creating a Practical Monthly Budget for Financial Success

When it comes to personal finance, one of the most important tools you can have in your arsenal is a practical monthly budget. It might not sound like the most exciting topic, but trust me when I say that a well-designed budget can have a profound impact on your financial success. Now, I know what…